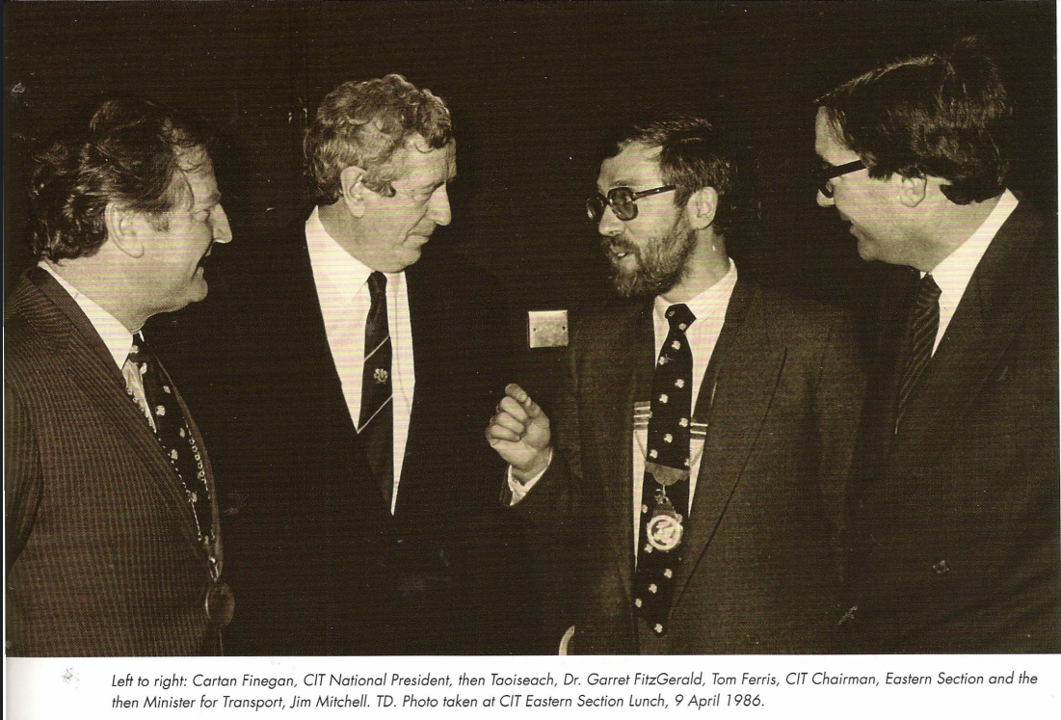

Remembering Garret FitzGerald (views of Tom Ferris, FCILT)

It is fitting that the Chartered Institute of Logistics and Transport should acknowledge the birth of Dr. Garret FitzGerald 100 years ago on 9 February 1926. Garret was made an Honorary Fellow of...

Read more